Financial reports in PDF format are essential for investors and analysts, offering crucial insights into a company’s performance.

Understanding these documents empowers effective financial analysis and strategic decision-making in today’s dynamic economic landscape.

Why Understanding Financial Reports is Crucial

Grasping financial reports is paramount for anyone involved in investment, lending, or managing a business. These reports unveil a company’s financial health, revealing its profitability, solvency, and liquidity – key indicators of its stability and future prospects.

For investors, reports illuminate whether a stock is undervalued or overvalued, guiding informed investment choices. Lenders rely on them to assess creditworthiness before extending loans. Managers utilize these insights to refine strategies, optimize resource allocation, and drive sustainable growth.

Ignoring these reports can lead to poor decisions, substantial financial losses, and missed opportunities. A solid understanding allows for accurate risk assessment, identification of emerging trends, and ultimately, more successful financial outcomes. Editable financial reports facilitate timely analysis, enhancing responsiveness to market changes and bolstering overall financial acumen.

The Prevalence of PDF Format

PDF (Portable Document Format) has become the standard for distributing financial reports due to its universal accessibility and preservation of formatting. Unlike editable documents, PDFs ensure that the report appears identically across all devices and operating systems, preventing unintentional alterations to critical data.

Companies favor PDFs for their security features, protecting sensitive financial information from unauthorized changes. Regulatory bodies often mandate PDF submissions to maintain data integrity and facilitate auditing processes. This widespread adoption necessitates proficiency in navigating and extracting information from these documents.

While offering consistency, PDFs can present challenges in analysis. However, modern PDF readers offer tools like search, zoom, and annotation features to overcome these hurdles. Understanding how to effectively utilize these tools is crucial for efficiently extracting valuable insights from financial reports presented in this ubiquitous format.

Key Financial Statements Found in a Report

Core statements – the balance sheet, income statement, and cash flow statement – provide a comprehensive view of a company’s financial health and performance.

Balance Sheet: A Snapshot of Assets, Liabilities, and Equity

The balance sheet presents a company’s assets, liabilities, and equity at a specific point in time, adhering to the fundamental accounting equation: Assets = Liabilities + Equity. Assets represent what the company owns – cash, accounts receivable, inventory, and property, plant, and equipment (PP&E).

Liabilities are what the company owes to others – accounts payable, salaries payable, debt, and deferred revenue. Equity represents the owners’ stake in the company. Analyzing the balance sheet reveals a company’s liquidity, solvency, and financial flexibility.

Key metrics include current ratio (current assets/current liabilities) and debt-to-equity ratio (total debt/total equity). Understanding these components provides a clear picture of the company’s financial position and its ability to meet its obligations. Careful examination of these elements is crucial for informed investment decisions.

Income Statement: Measuring Profitability Over a Period

The income statement, also known as the profit and loss (P&L) statement, reports a company’s financial performance over a specific period. It begins with revenue, then subtracts the cost of goods sold (COGS) to arrive at gross profit. Operating expenses, such as selling, general, and administrative costs, are then deducted to calculate operating income.

Further deductions include interest expense and taxes, leading to net income – the “bottom line.” Key profitability ratios derived from the income statement include gross profit margin (gross profit/revenue) and net profit margin (net income/revenue).

Analyzing trends in revenue, expenses, and profitability provides insights into a company’s operational efficiency and overall financial health. Investors use this statement to assess a company’s ability to generate profits and sustain growth.

Cash Flow Statement: Tracking the Movement of Cash

The cash flow statement details the movement of cash both into and out of a company during a specific period, categorized into three main activities: operating, investing, and financing. Operating activities reflect cash generated from core business operations – sales, expenses, etc.

Investing activities involve purchases and sales of long-term assets, like property, plant, and equipment (PP&E). Financing activities relate to debt, equity, and dividends. A positive cash flow from operating activities is generally a good sign, indicating the company generates sufficient cash from its core business.

Analyzing the cash flow statement helps assess a company’s liquidity, solvency, and ability to fund future growth. It provides a more realistic view of financial health than the income statement alone, as it accounts for non-cash items and timing differences.

Navigating a Financial Report PDF

Effectively reading financial PDFs requires utilizing features like search, zoom, and annotations to pinpoint key data and understand complex structures within the report.

Understanding the Report Structure & Table of Contents

Financial report PDFs typically follow a standardized structure, beginning with a cover page and progressing through sections detailing the company’s performance. The table of contents is your initial roadmap, outlining the report’s organization and page numbers for each key component.

Familiarize yourself with the typical order: an introductory overview, management’s discussion and analysis (MD&A), the independent auditor’s report, and then the core financial statements – the balance sheet, income statement, and cash flow statement.

Pay attention to headings and subheadings; they provide a hierarchical view of the information. Look for notes accompanying the statements, as these offer crucial context and explanations. Understanding this structure allows you to quickly locate specific information and grasp the overall narrative presented within the financial report. A well-organized report facilitates efficient analysis and informed decision-making.

Utilizing PDF Reader Features (Search, Zoom, Annotations)

Reading financial report PDFs effectively requires leveraging the tools within your PDF reader. The search function is invaluable for quickly locating specific terms, figures, or disclosures within lengthy documents. Utilize keywords like “revenue,” “debt,” or specific account names to pinpoint relevant information.

The zoom feature allows for detailed examination of tables and charts, ensuring accurate data interpretation. Annotation tools – highlighting, underlining, and adding notes – are crucial for marking important findings and creating a personalized study guide.

Don’t hesitate to use these features to actively engage with the report. Bookmark key pages for easy access, and utilize the commenting function to pose questions or record your thoughts. Mastering these PDF reader capabilities transforms a potentially daunting task into a streamlined and productive analytical process.

Identifying Key Sections: Management Discussion & Analysis (MD&A)

Within a financial report PDF, the Management Discussion & Analysis (MD&A) section is paramount. This narrative, penned by company management, provides context and insights beyond the raw numbers. It explains the reasons behind financial performance, identifies trends, and outlines potential risks and opportunities.

Pay close attention to how management interprets the financial results. Do their explanations align with the data presented in the financial statements? Look for discussions of key performance indicators (KPIs) and any significant changes in accounting policies.

The MD&A often reveals crucial information about a company’s strategy and future outlook. Critically assess management’s perspective, considering potential biases, and cross-reference their statements with other sections of the report for a comprehensive understanding.

Decoding Financial Data

Analyzing financial reports requires understanding key ratios, trend comparisons, and footnotes. These elements reveal a company’s financial health, profitability, and potential risks to investors.

Key Financial Ratios: Liquidity, Profitability, Solvency

Financial ratios are powerful tools for interpreting data within a financial report PDF. Liquidity ratios, such as the current ratio and quick ratio, assess a company’s ability to meet short-term obligations. A higher ratio generally indicates better liquidity.

Profitability ratios, including gross profit margin and net profit margin, reveal how efficiently a company generates profits from its revenue. These ratios are vital for evaluating overall performance.

Solvency ratios, like the debt-to-equity ratio, measure a company’s ability to meet its long-term obligations. A lower ratio suggests a stronger financial position and reduced risk. Understanding these ratios, alongside trend analysis, provides a comprehensive view of a company’s financial health as presented in the PDF report.

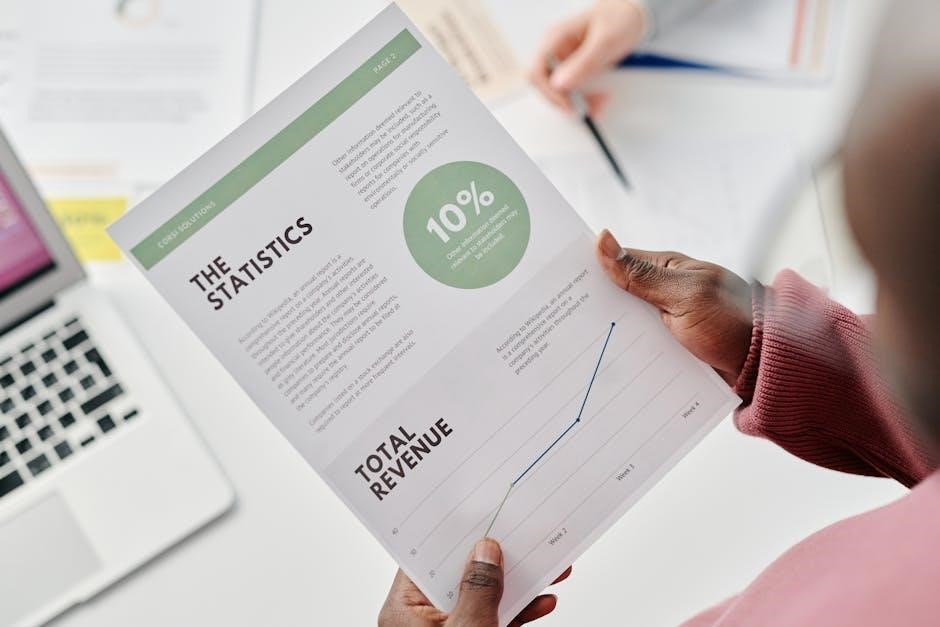

Analyzing Trends: Comparing Data Across Periods

Trend analysis is a cornerstone of interpreting financial report PDFs effectively. Comparing financial data across multiple periods – quarterly or annually – reveals crucial patterns and insights. Look for consistent growth, declines, or fluctuations in key metrics like revenue, profit, and cash flow.

Horizontal analysis involves calculating percentage changes between periods, highlighting significant variances. Vertical analysis expresses each line item as a percentage of a base figure (like revenue), enabling comparisons within a single period.

Identifying these trends helps assess a company’s performance trajectory and predict future outcomes. Consistent positive trends suggest a healthy business, while negative trends may signal potential problems requiring further investigation within the PDF document. This comparative approach transforms raw data into actionable intelligence.

Understanding Footnotes: The Fine Print Matters

Footnotes within a financial report PDF are often overlooked, yet they contain critical details that clarify the numbers presented in the main financial statements. These notes provide essential context, explaining accounting policies, significant assumptions, and details behind specific figures.

Carefully review footnotes related to revenue recognition, debt obligations, and contingent liabilities. They can reveal hidden risks or opportunities not immediately apparent from the headline numbers. Footnotes also disclose details about acquisitions, divestitures, and other significant events impacting the company’s financial position.

Ignoring footnotes is akin to reading only half the story. They provide a deeper understanding of the company’s financial health and are crucial for accurate interpretation of the PDF report. Diligent footnote analysis is a hallmark of thorough financial due diligence.

Common Challenges & Solutions

Navigating complex PDFs and industry jargon can be daunting. Utilizing search functions, zooming tools, and glossaries will enhance comprehension and unlock valuable insights.

Dealing with Complex Formatting in PDFs

Financial report PDFs often present formatting challenges, including inconsistent layouts, dense tables, and small fonts. These complexities can hinder efficient data extraction and analysis. To overcome these hurdles, leverage the advanced features of your PDF reader.

Utilize the reflow text feature, if available, to adjust the text layout for easier reading. Zooming in on specific sections is crucial for detailed examination of figures and notes. Employing the ‘select text’ tool allows for copying data into spreadsheets for further manipulation and analysis.

Be mindful of column alignment within tables, as misalignments can lead to misinterpretation of data. Consider converting the PDF to a more manageable format, like Excel, if extensive data manipulation is required, but always verify the accuracy of the conversion. Patience and a systematic approach are key to successfully navigating complex PDF formatting.

Interpreting Industry-Specific Terminology

Financial reports are laden with specialized terminology that varies significantly across industries. Understanding these terms is paramount for accurate interpretation. For example, “revenue per available room” (RevPAR) is crucial in hospitality, while “average daily production” (ADP) is key in oil and gas.

Consult industry glossaries and resources to decipher unfamiliar terms. Don’t hesitate to research acronyms and abbreviations – a quick online search often provides clarity. Pay close attention to how companies define specific metrics within the footnotes of their reports, as definitions can differ.

Context is vital; a term’s meaning can shift depending on the industry. Recognizing these nuances prevents misinterpretations and ensures a more informed assessment of a company’s financial health. Building a strong understanding of industry-specific language is an ongoing process, essential for effective financial report analysis.

Verifying Data Accuracy & Identifying Red Flags

Scrutinizing financial reports requires a critical eye for potential inaccuracies and warning signs. Cross-reference key figures with prior periods and industry benchmarks to identify unusual fluctuations. Look for inconsistencies between different sections of the report – discrepancies can signal errors or even fraudulent activity.

Pay attention to unusual trends, such as a sudden spike in revenue without a corresponding increase in sales volume. Investigate significant changes in accounting methods, as these can distort financial results. Be wary of overly optimistic management commentary that doesn’t align with the underlying data.

Footnotes are crucial for uncovering hidden details and potential issues. Always question anything that seems unclear or inconsistent. Remember, a healthy skepticism is your best defense when analyzing financial information and spotting potential red flags.